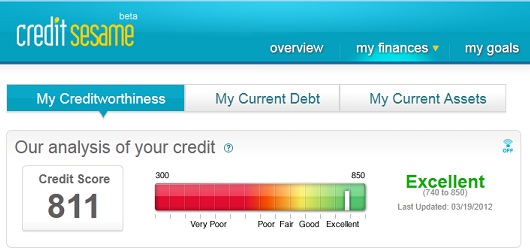

Looking for your free credit score? If you haven’t checked your credit score with Credit Sesame, you can do it totally free. Credit Sesame is REALLY FREE, there is NO credit card required! I personally use it every month. It’s fabulous!

Looking for your free credit score? If you haven’t checked your credit score with Credit Sesame, you can do it totally free. Credit Sesame is REALLY FREE, there is NO credit card required! I personally use it every month. It’s fabulous!

It’s super easy, just enter your basic information at Credit Sesame HERE. In about 2 minutes you’ll have your free Credit Score. You’ll actually be able to track yo ur credit score for free every month for free. I find it really handy and a nice way to see if there are any changes month to month. If you have already signed up be sure to log-in and see what your current score is.

ur credit score for free every month for free. I find it really handy and a nice way to see if there are any changes month to month. If you have already signed up be sure to log-in and see what your current score is.

Remember, your credit score is used by potential employers, landlords, insurance companies, banks, mortgage companies and many others to make decisions about you, so it’s important to know your score! The average score is about 678. You can see what your score is HERE.

If you have any questions after getting your score, just leave it in the comments. I’ll be happy to answer them! Good Luck! 🙂

Hi, I'm Christie and I love helping people save money! In my family, it's all about saving more and spending less. I started using coupons to help pay off debt. Once I realized we could save literally hundreds of dollars a month with coupons, my life has never been the same. Join me in saving money at one of my favorite stores - CVS!

Hi, I'm Christie and I love helping people save money! In my family, it's all about saving more and spending less. I started using coupons to help pay off debt. Once I realized we could save literally hundreds of dollars a month with coupons, my life has never been the same. Join me in saving money at one of my favorite stores - CVS!

{ 3 comments… read them below or add one }

My credit score is just 4 points away from 800 and we have managed to pay extra on our car payment every month (partly thanks to coupoing:) and next month we will have it paid off 3 years early!! After we pay this off will it bump our score up? Also I have 2 old credit cards (1 is a department store card and the other is a credit card) that we never use, I actually thought I had closed those accounts a long time ago, if I close those 2 will that bump up my score? I’m just trying to get it bumped up to see that 800 🙂 One last question, I know 740 is considered “prime” is there any credit score level that is considered higher than that generally? Thanks!!

Hey Lindsay – Ironically closing down the two cards won’t help. It either won’t do much or it could actually hurt you. I would suggest if you’d like to close them – close one (the one with the lower available credit) and then wait before closing the other one (6 months or so). Paying off the car will save you $ (less interest) but may not do much for your score. Actually 780+ is kind of like the super best tier – and that’s you!!!! 🙂 Awesome job!

Good to know! Thanks so much Christie! I love your site and thank you for your dedication to helping all of us save money!